3 Graphs To Show This Isn’t a Housing Bubble

With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time.

There’s a Shortage of Homes on the Market Today, Not a Surplus

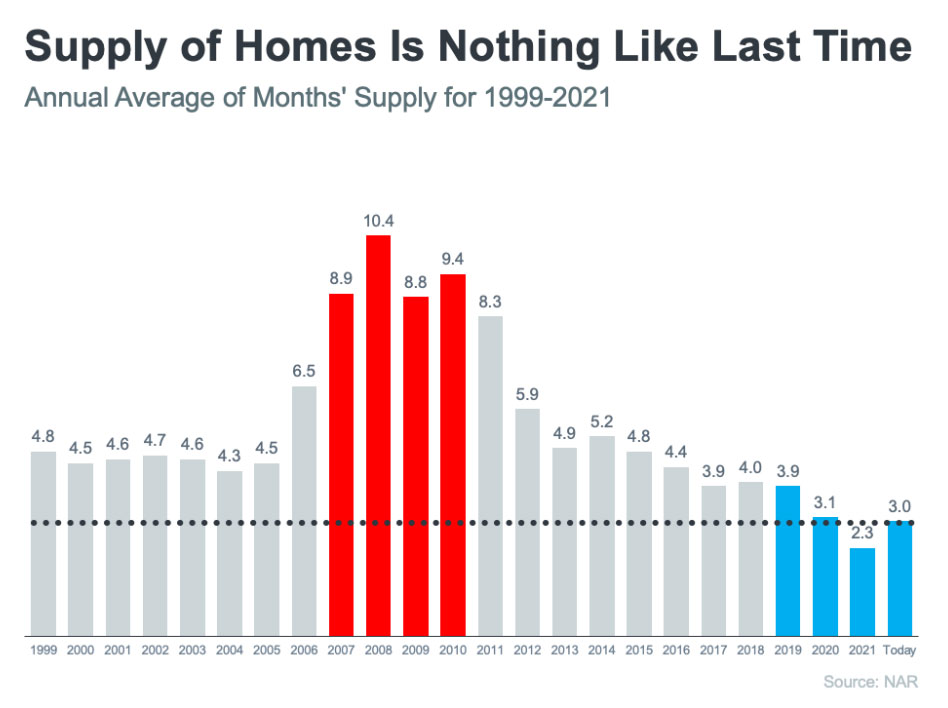

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation.

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to tumble. Today, supply is growing, but there’s still a shortage of inventory available.

The graph below uses data from the National Association of Realtors (NAR) to show how this time compares to the crash. Today, unsold inventory sits at just a 3.0-months’ supply at the current sales pace.

One of the reasons inventory is still low is because of sustained underbuilding. When you couple that with ongoing buyer demand as millennials age into their peak homebuying years, it continues to put upward pressure on home prices. That limited supply compared to buyer demand is why experts forecast home prices won’t fall this time.

Mortgage Standards Were Much More Relaxed During the Crash

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. The graph below showcases data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The higher the number, the easier it is to get a mortgage.

Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

Today, things are different, and purchasers face much higher standards from mortgage companies. Mark Fleming, Chief Economist at First American, says:

“Credit standards tightened in recent months due to increasing economic uncertainty and monetary policy tightening.”

Stricter standards, like there are today, help prevent a risk of a rash of foreclosures like there was last time.

The Foreclosure Volume Is Nothing Like It Was During the Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been on the way down since the crash because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help tell the story:

In addition, homeowners today are equity rich, not tapped out. In the run-up to the housing bubble, some homeowners were using their homes as personal ATMs. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at considerable discounts that lowered the value of other homes in the area.

Today, prices have risen nicely over the last few years, and that’s given homeowners an equity boost. According to Black Knight:

“In total, mortgage holders gained $2.8 trillion in tappable equity over the past 12 months – a 34% increase that equates to more than $207,000 in equity available per borrower. . . .”

With the average home equity now standing at $207,000, homeowners are in a completely different position this time.

Bottom Line

If you’re worried we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your concerns. Concrete data and expert insights clearly show why this is nothing like the last time.

Why It’s Still a Sellers’ Market

As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal.

Even though the supply of homes for sale has been growing this year, there’s still a shortage of homes on the market. And that means conditions continue to favor sellers today. That’s because the level of inventory of homes for sale can help determine if buyers or sellers are in the driver’s seat. Think of it like this:

- A buyers’ market is when there are more homes for sale than buyers looking to buy. When that happens, buyers have the negotiation power because sellers are more willing to compromise so they can sell their house.

- In a sellers’ market, it’s just the opposite. There are too few homes available for the number of buyers in the market and that gives the seller all the leverage. In that situation, buyers will do what they can to compete for the limited number of homes for sale.

- A neutral market is when supply is balanced and there are enough homes to meet buyer demand at the current sales pace.

And for the past two years, we’ve been in a red-hot sellers’ market because inventory has been near record lows. The blue section of this graph highlights just how far below a neutral market inventory still is today.

What Does This Mean for You?

Ed Pinto, Director of the American Enterprise Institute’s Housing Center, gives a perfect summary of what’s happening in today’s market, saying:

“Overall, the best summary is that we’ll move from a gangbuster sellers’ market to a modest sellers’ market.”

Conditions are still in your favor even though the market is cooling. If you work with an agent to price your house at market value, you’ll find success when you sell your house today. While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed.

Bottom Line

Today’s housing market still favors sellers. If you’re ready to sell your house, let’s connect so you can start making your moves.

Want To Buy a Home? Now May Be the Time.

There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you:

“This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession. . . They’ll have fewer buyers to compete with.”

Two Reasons There Are More Homes for Sale

The first reason the market is seeing more homes available for sale is the number of sales happening each month has decreased. This slowdown has been caused by rising mortgage rates and rising home prices, leading many to postpone or put off buying. The graph below uses data from realtor.com to show how active real estate listings have risen over the past four months as a result.

The second reason the market is seeing more homes available for sale is because the number of people selling their homes is also rising. The graph below outlines new monthly listings coming onto the market compared to last year. As the graph shows, for the past three months, more people have put their homes on the market than the previous year.

Bottom Line

The number of homes for sale across the country is growing, and that means more options for those thinking about buying a home. This is the opportunity many have been waiting for who were outbid or out priced last year.

What Does an Economic Slowdown Mean for the Housing Market?

According to a recent survey, more and more Americans are concerned about a possible recession. Those concerns were validated when the Federal Reserve met and confirmed they were strongly committed to bringing down inflation. And, in order to do so, they’d use their tools and influence to slow down the economy.

All of this brings up many fears and questions around how it might affect our lives, our jobs, and business overall. And one concern many Americans have is: how will this affect the housing market? We know how economic slowdowns have impacted home prices in the past, but how could this next slowdown affect real estate and the cost of financing a home?

According to Mortgage Specialists:

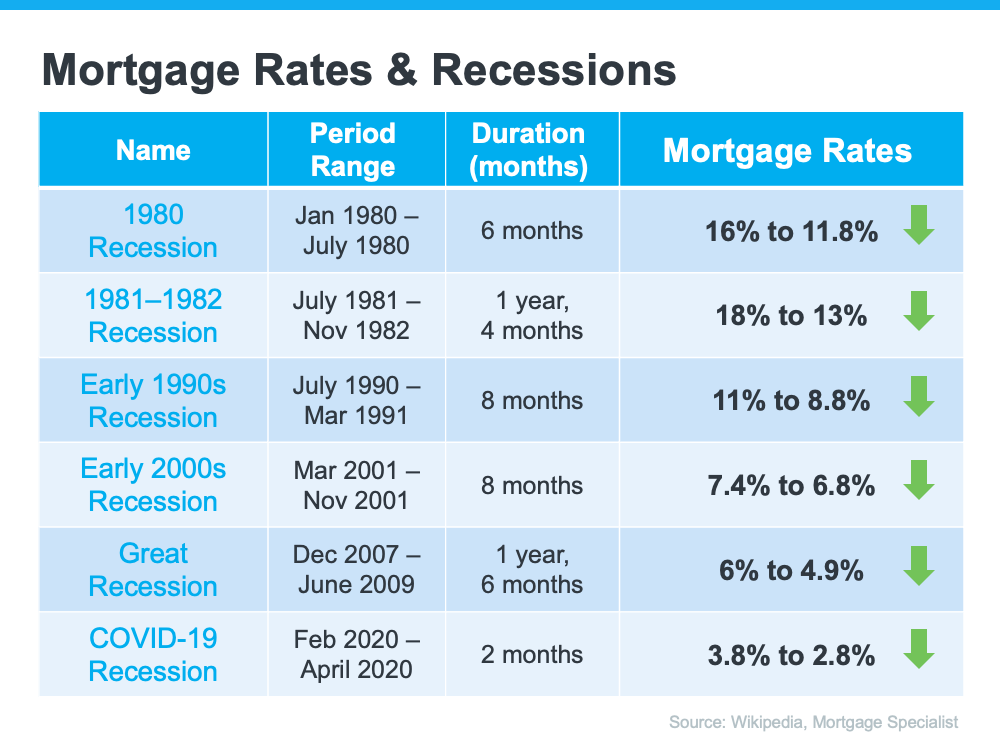

“Throughout history, during a recessionary period, interest rates go up at the beginning of the recession. But in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward.”

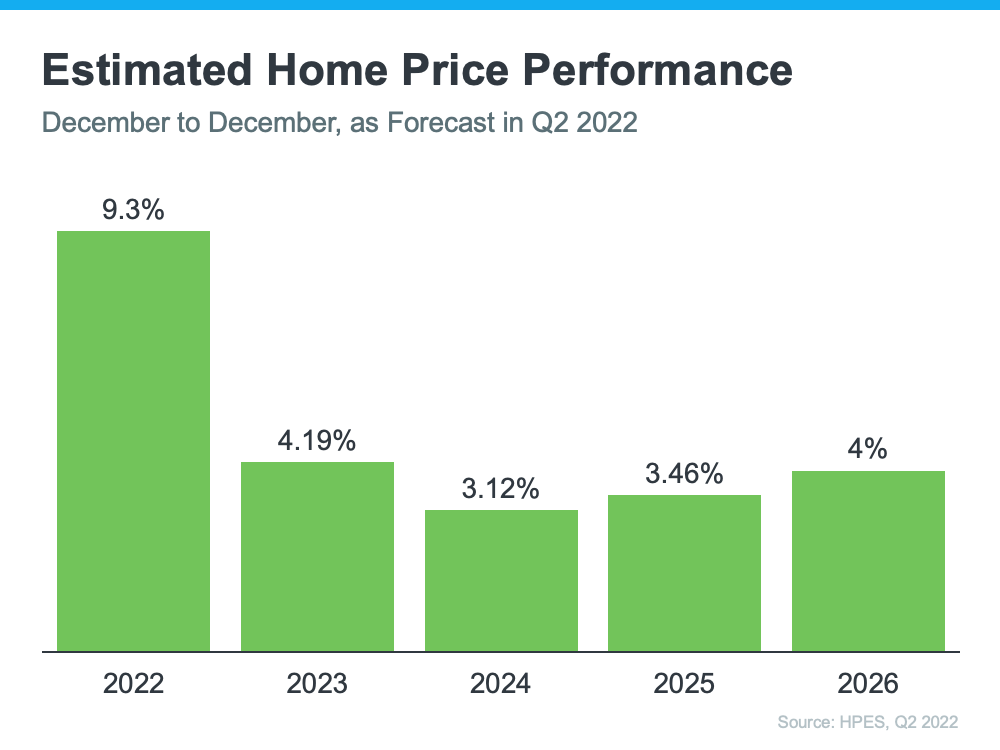

Here’s the data to back that up. If you look back at each recession going all the way to the early 1980s, here’s what happened to mortgage rates during those times (see chart below):

As the chart shows, historically, each time the economy slowed down, mortgage rates decreased. Fortune.com helps explain the trend like this:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

And while history doesn’t always repeat itself, we can learn from it. While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

Bottom Line

Concerns of a recession are rising. As the economy slows down, history tells us this would likely mean lower mortgage rates for those looking to refinance or buy a home. While no one knows exactly what the future holds, you can make the right decision for you by working with a trusted real estate professional to get expert advice on what’s happening in the housing market and what that means for your homeownership goals.

How Your Equity Can Grow over Time

It’s true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says:

“The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth.”

That’s great for your home’s value over the last couple of years, but what if you’ve lived in your home for longer than that? You may be wondering how much equity you truly have.

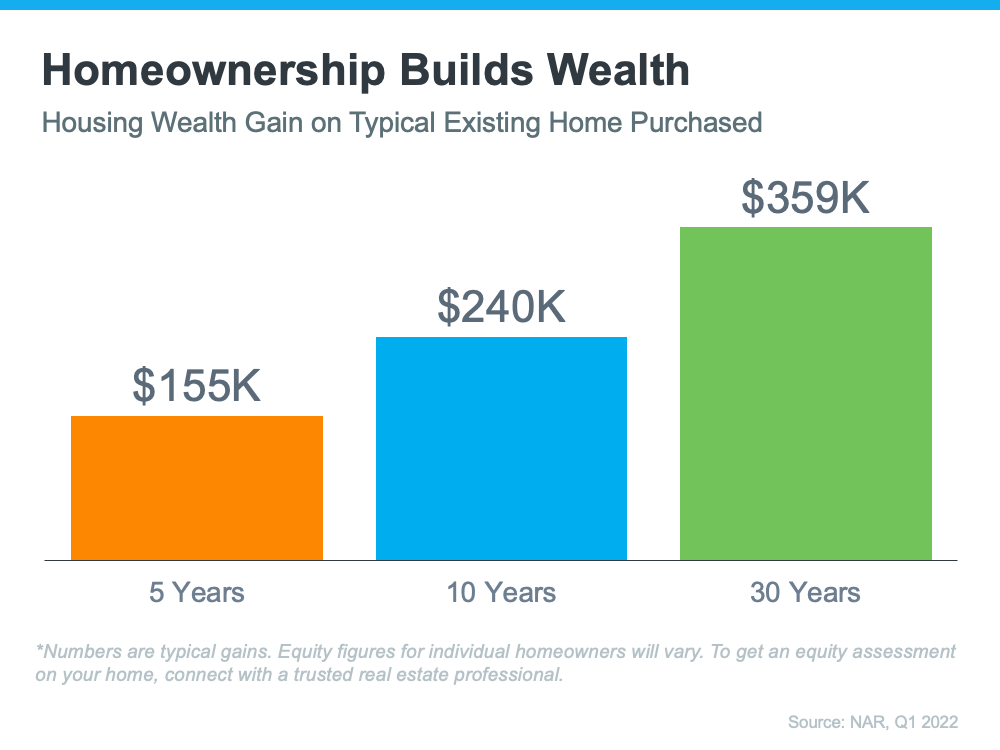

The National Association of Realtors (NAR) has done a study to calculate the typical equity gains over longer spans of time. The data they compiled could be enough to motivate you to move. Just remember, to find out how much equity you have in your specific home, you’ll want to get a professional equity assessment from a trusted real estate advisor.

How Your Equity Grows

Let’s start by establishing how you build equity in your home. While price appreciation is clearly a factor that can help boost your equity, you also build equity over time as you pay down your home loan. NAR explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

Average Equity Growth over Time

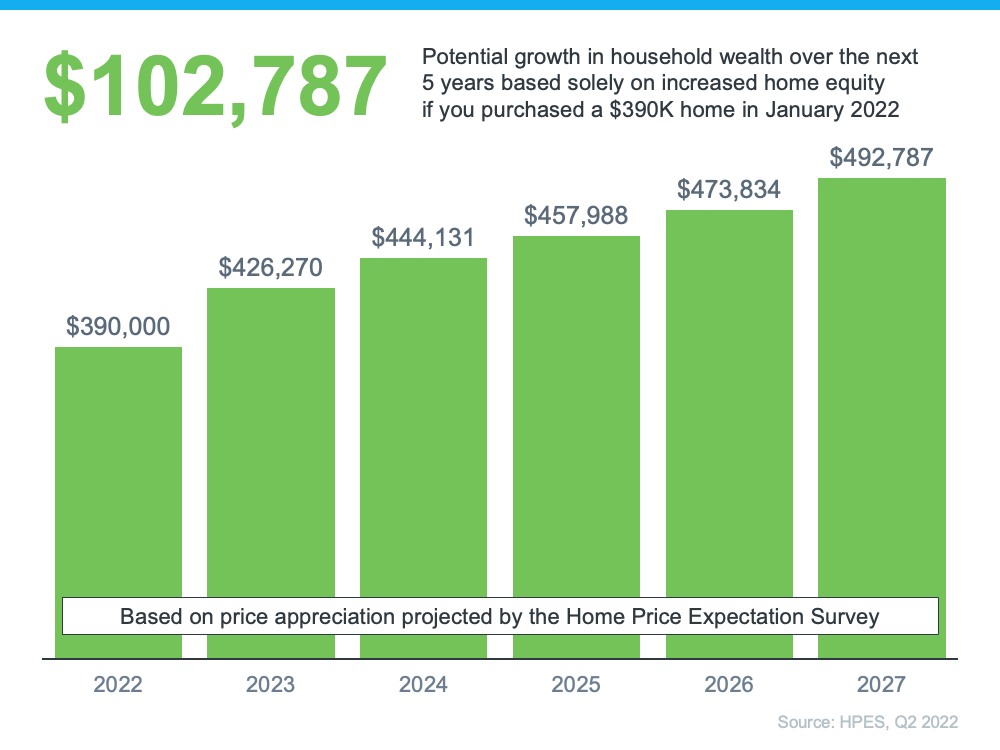

The study from NAR breaks down the typical equity gain over time (see graph below). It calculates the equity a homeowner potentially gained if they purchased the median-priced home 5, 10, or 30 years ago and still own it today.

These six-figure numbers are impressive and certainly enough to help you fuel a move into your next home, but they’re not a promised amount. Remember, your own equity gain will be different. It depends on how long you’ve been in the house, your home’s condition, any upgrades you’ve made, your area, and much more.

If you want to find out how much equity you have, partner with a trusted real estate professional for an equity assessment on your home. They can provide an expert opinion on what your house is worth today and how the equity you’ve gained over time can help you when you purchase your next home. It may be some (if not all) of what you need for your next down payment.

Bottom Line

If you’re thinking about selling your house and making a move, home equity can be a real game-changer, especially if you’ve been in your current home for a while. If you’re ready to find out how much equity you have, let’s connect.

Homeownership Could Be in Reach with Down Payment Assistance Programs

A recent survey from Bankrate asks prospective buyers to identify the biggest obstacles in their homebuying journey. It found that 36% of those polled said saving for a down payment is one of their primary hurdles to buying a home.

If you feel the same way, the good news is there are many down payment assistance programs available that can help you achieve your homeownership goals. The key is understanding where to look and learning what options are available. Here’s some information that can help you.

You Can Qualify Even if You’ve Purchased a Home Before

There are several misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too. According to the latest Homeownership Program Index from downpaymentresource.com:

“It is a common misconception that homebuyer assistance is only available to first-time homebuyers, however, 38% of homebuyer assistance programs in Q1 2022 did not have a first-time homebuyer requirement.”

That means repeat buyers could qualify for over one-third of the assistance programs available. And if you’re a repeat buyer, you may still be able to take advantage of some first-time homebuyer programs, depending on your personal situation. That’s because downpaymentresource.com also notes many of the first-time homebuyer programs use the U.S. Department of Housing and Urban Development’s definition of a first-time homebuyer. Under their definition, you could qualify as a first-time buyer if you’re:

- Someone who hasn’t owned a primary residence in 3 years.

- A single parent who’s only ever owned a home with a former spouse.

That means no matter where you are in your homeownership journey, there could be an option available for you.

You May Be Eligible for Programs Based on Your Location or Profession

In addition to broader options available for repeat and first-time homebuyers, there are other types of down payment assistance programs that you could qualify for based on your location. According to the National Association of Realtors (NAR):

“Many local governments and non-profit organizations offer down-payment assistance grants and loans, targeted to area borrowers and often with specific borrower requirements.”

Plus, there are programs and special benefits for individuals working in certain professions or with unique statuses, including teachers, doctors and nurses, and veterans.

Ultimately, that means there are many federal, state, and local programs available for you to explore. The best way to do that is to connect with a local real estate professional and your lender to learn more about what’s available in your area.

Bottom Line

Down payment assistance programs have helped many homebuyers achieve their dreams, and if you qualify, they could help you too. Let’s connect today so you can begin exploring your options.

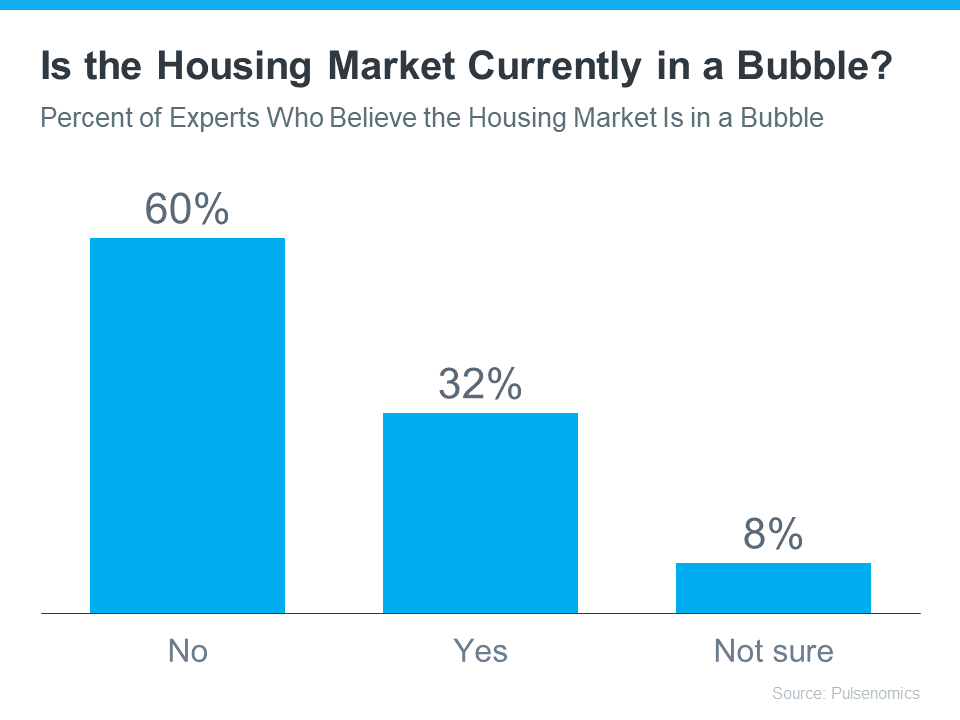

Two Reasons Why Today’s Housing Market Isn’t a Bubble

You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it’s important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in a bubble. The results indicate most experts don’t think that’s the case (see graph below):

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

- The recent growth in home prices is because of demographics and low inventory

- Credit risks are low because underwriting and lending standards are sound

If you’re concerned a crash may be coming, here’s a deep dive into those two key factors that should help ease your concerns.

1. Low Housing Inventory Is Causing Home Prices To Rise

The supply of homes available for sale needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation.

As the graph below shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation (see graph below):

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

“The fundamentals driving house price growth in the U.S. remain intact. . .. The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.”

2. Mortgage Lending Standards Today Are Nothing Like the Last Time

During the housing bubble, it was much easier to get a mortgage than it is today. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the years after:

This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.”

Bottom Line

A majority of experts agree we’re not in a housing bubble. That’s because home price growth is backed by strong housing market fundamentals and lending standards are much tighter today. If you have questions, let’s connect to discuss why today’s housing market is nothing like 2008.

A Key Opportunity for Homebuyers

There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the past two years. Two of the biggest hurdles homebuyers faced during the pandemic were the limited number of homes for sale and the intensity and frequency of bidding wars. But those two things have reached a turning point.

As you may have already heard, the number of homes for sale has increased this year, and even more so this spring. As Danielle Hale, Chief Economist for realtor.com, explains:

“New listings–a measure of sellers putting homes up for sale–were up 6% above one year ago. Home sellers in many markets across the country continue to benefit from rising home prices and fast-selling homes. That’s prompted a growing number of homeowners to sell homes this year compared to last, giving home shoppers much needed options.”

This is encouraging news. More homes coming onto the market give you a greater chance of finding one that checks all your boxes.

Buyer Competition Moderating Helps Inventory Grow Even More

Mark Fleming, Chief Economist at First American, says inventory growth is happening not just because there’s an increase in the number of listings coming onto the market, but also because buyer demand has moderated some in light of higher mortgage rates and other economic factors:

“There has been a pickup in the inventory that we’ve seen recently, but it’s not from a big increase in new listings . . . but rather a slowdown in the pace of sales. And remember that months’ supply measures the inventory of sale relative to the pace of sales. Same inventory, fewer sales, means more months’ supply.”

Basically, the market is shifting away from the frenzy of buyer competition seen during the pandemic, and that’s helping available inventory grow. In their latest forecast, realtor.com also mentions the moderation of demand as a key factor and projects the inventory growth should continue:

“As rising inflation and mortgage rates bring U.S. housing demand back from the 2021 frenzy, . . . inventory will grow double-digits over 2021 and offer buyers a better-than-expected chance to find a home.”

How This Impacts You

The combination of more homes coming onto the market and a slower pace of home sales means you’ll have more options to choose from as you search for your next home. That’s great news if you’ve been searching for a while with little to no luck. Just remember, there isn’t a sudden surplus of inventory, just more homes to choose from than even a few months ago. So, you’ll still want to be decisive and move fast when you find the right home for you.

And when you do, you may be faced with less competition from other buyers too. If you’ve been waiting to jump into the market because the intensity of the bidding wars was intimidating or if you’ve been outbid on several homes, this moderation could help make the homebuying process a bit smoother. It’s not that it’ll be easy or that bidding wars are a thing of the past – that’s not the case. But it won’t feel nearly as impossible.

Bottom Line

As the housing market begins its shift back toward pre-pandemic levels, you could have a unique opportunity in front of you. With moderating levels of buyer competition and more homes actively for sale, your home search may have gotten a bit less challenging. Let’s connect to begin the process today.

The Average Homeowner Gained $64K in Equity over the Past Year

If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price appreciation, you’re building that equity far faster than you may expect – here’s how it works.

Because there’s an ongoing imbalance between the number of homes available for sale and the number of buyers looking to make a purchase, home prices are on the rise. That means your home is worth more in today’s market because it’s in high demand. As Patrick Dodd, President and CEO of CoreLogic, explains:

“Price growth is the key ingredient for the creation of home equity wealth. . . . This has led to the largest one-year gain in average home equity wealth for owners. . . .”

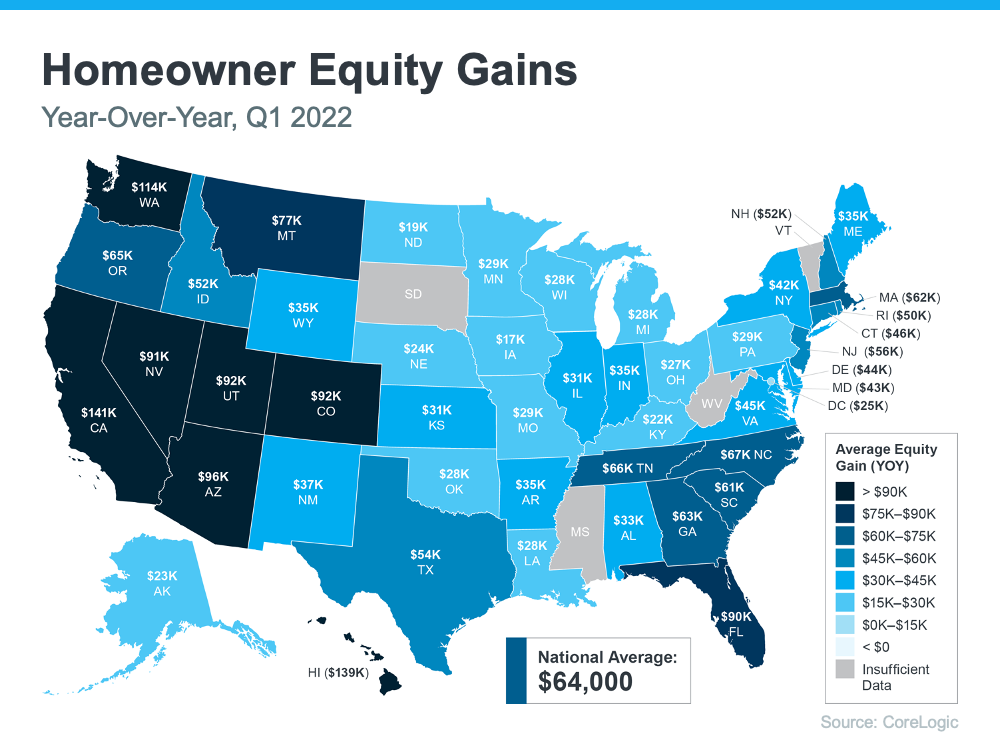

Basically, because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $64,000 over the last 12 months.

While that’s the nationwide number, if you want to know what’s happening in your area, look at the map below. It breaks down the average year-over-year equity growth for each state using the data from CoreLogic.

The Opportunity Your Rising Home Equity Provides

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale. In a market where homeowners are gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling or you’re worried about being priced out of your next home because of today’s ongoing home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

If you’re planning to make a move, the equity you’ve gained can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link