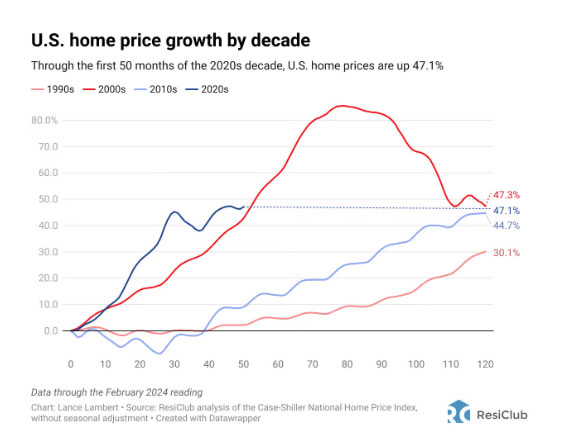

You may have noticed an uptick in construction and newly built homes. But it’s not just a trend we’re seeing here in Northwest Montana. In fact, about one-third of single-family homes for sale today are newly constructed, a dramatic increase from pre-pandemic levels.

Let’s dive into why new construction homes are dominating the market and what you should keep in mind if you’re thinking about buying one.

The Rise of New Construction Homes

Since 2019, the landscape of the real estate market has shifted significantly. Remote work, low mortgage rates, and increased demand for homes prompted builders to ramp up construction.

Even as demand has slightly cooled and mortgage rates have risen, new builds continue to play a crucial role in the housing market. Nationally, newly built homes made up 33.4% of the market in Q1 2024 according to Redfin—a trend that’s holding steady.

Why New Construction Homes Are in High Demand

Limited Supply of Existing Homes

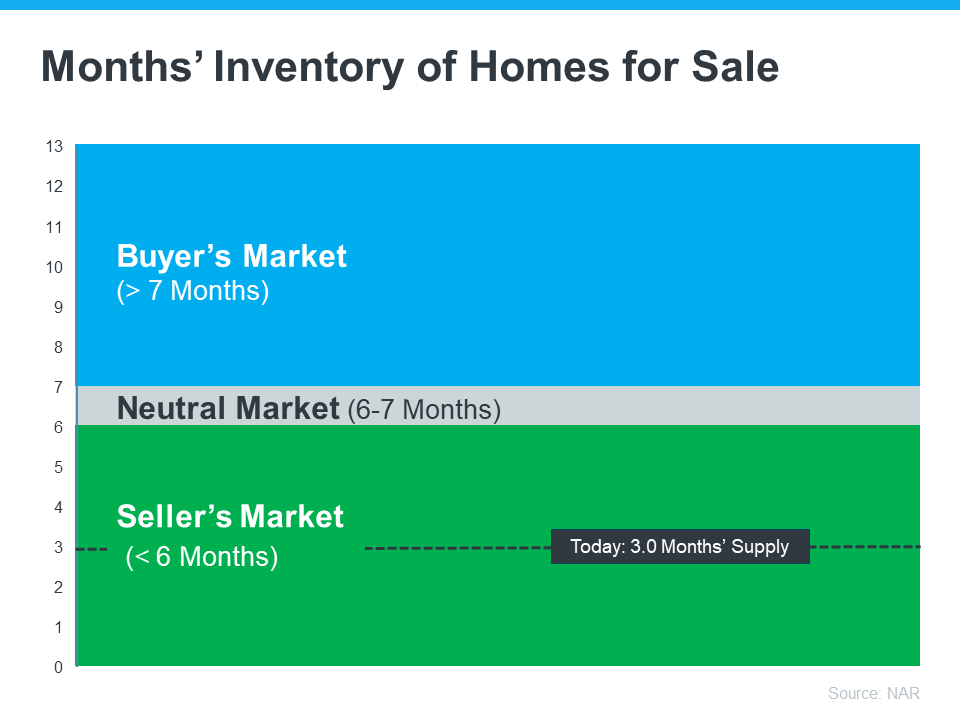

Builders are constructing about 1 million single-family homes a year. At the same time, many homeowners are reluctant to sell their existing homes due, in part, to high mortgage rates. Robert Dietz, chief economist at the National Association of Home Builders (NAHB), explained, “The level of resale inventory has shrunk.”

With a smaller number of existing homes on the market, new construction takes up a bigger portion of the total housing inventory. Buyers today are exploring all their options, from fixer-uppers to renovated properties to new construction.

Attractive Pricing and Incentives

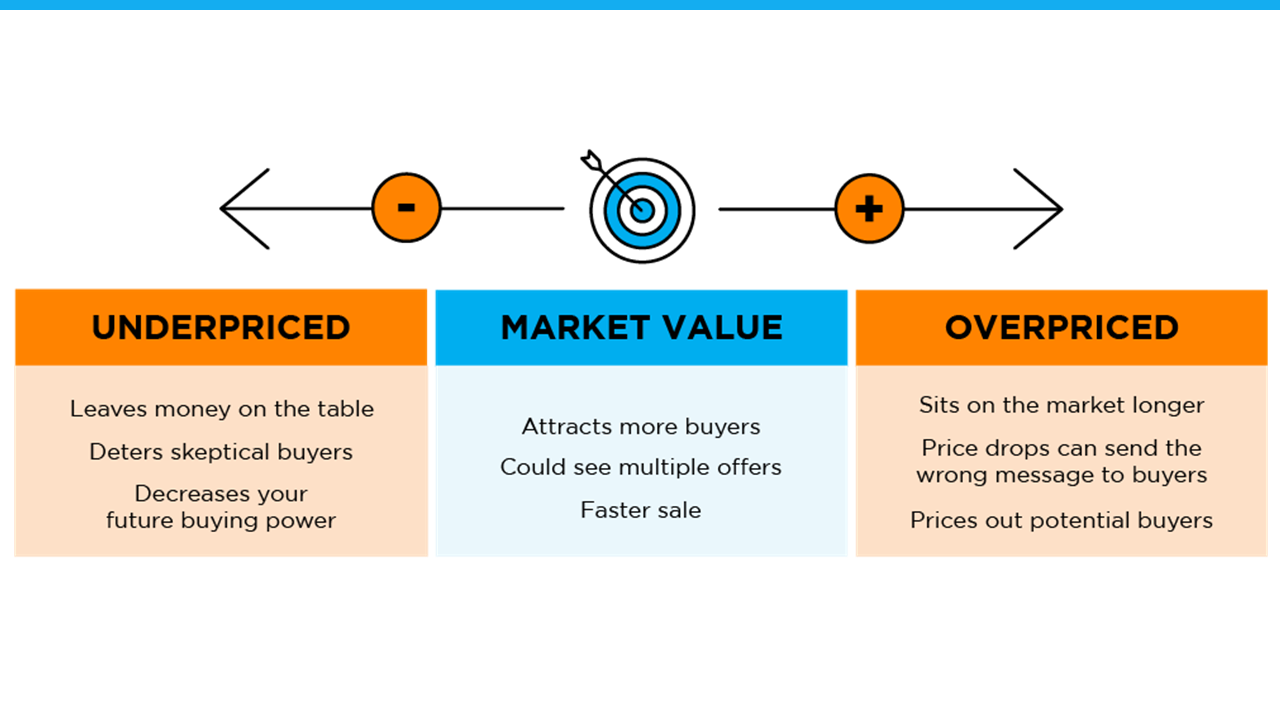

Builders are inclined to sell their inventory and are often more flexible with pricing than individual home sellers. To attract buyers, they frequently offer incentives such as mortgage rate buy-downs, price cuts, and covering closing costs.

In addition, new homes are becoming more affordable compared to existing ones. According to the U.S. Census Bureau, the median sale price for new houses in March was $430,700, only 4% higher than the median price of existing homes. This price gap is significantly smaller than in pre-pandemic times, when new homes were priced over 40% higher.

Matthew Walsh, assistant director and economist at Moody’s Analytics, told CNBC, “Prices are much closer to parity than during any point in the last three decades.”

What does this mean for you as a buyer?

While some buyers believe newly built homes are too expensive—or too much of a hassle—new construction does offer some unique advantages:

- More flexible pricing: Unlike traditional home sellers, builders may be more willing to negotiate on price, offer concessions like closing cost assistance, or even include upgrades as incentives.

- The latest features and energy efficiency: New homes are built to meet the latest building codes and often come with modern features that can save you money on utilities in the long run.

- Less maintenance: Brand new homes come with the benefit of not needing immediate repairs or renovations. You can move right in and enjoy your new space!

Things to Consider Before You Buy

Although new construction offers some great benefits, there are also some things to keep in mind:

- Wait times: New construction homes aren’t always move-in ready. Depending on the stage of construction, you may have to wait several months before you can close on the house.

- Limited space: Over the past few years, builders have been building smaller homes to help offset the costs of construction and help with affordability challenges. According to the NAHB, the median new single-family home was 2,156 square feet in Q4 2023, the lowest reading since 2010.

- Future costs: Property taxes on new builds are often based on estimates and can increase significantly after the first year. Be sure to factor this into your budget.

Final Thoughts

With one-third of the market consisting of new builds, there are ample opportunities for buyers to find a home that meets their needs. While there are unique considerations when buying new construction, the benefits often outweigh the challenges. From modern amenities and energy efficiency to customization options and attractive incentives, a newly built home could be the perfect fit for your next move.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link